April 1, 2024

- Juliana Duque, Associate, Asensi Abogados, Colombia

- Juan Camillo Carrasco, Partner, Asensi Abogados, Colombia

Outlook for mergers and acquisitions in Colombia and Latin American

Having legalized games of chance back in 2015, the sector in Colombia is now mature enough to attract the attention of international investors and experience the same cycles of consolidation witness elsewhere. Elsewhere markets are opening up to opportunities

In the last decade, Colombia has made significant progress in its business environment, creating one of the most stable legal and financial regimes for foreign investors who are willing to diversify their portfolio of interests and expand in the growing LATAM region.

This was further reinforced when Colombia became the first jurisdiction to approve a specific legal framework for the online gaming industry, creating a stable and safe jurisdiction for local and foreign investors. Figures from December 2022 showed the Colombian online gambling industry accounted for a total turnover of US$ 7 billion, representing growth of more than 70 percent compared to 2021. Whilst figures for 2023 are not yet available, we are expecting the year to show a similar rate of growth. The size and growth experienced by the country make Colombia an increasingly important market. It has also made Colombia an attractive market to operators looking to build profitable operations and extend their brands.

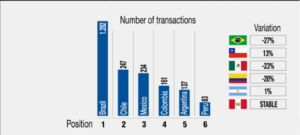

The delayed effects of the pandemic materialized during 2023, impacting the M&A industry in Colombia, as transactions decreased by 20 percent compared with the 12 months of 2022. Other Latin Americans jurisdictions were also severely affected as the data in figure 1 shows.

(source: TTR Data)

Despite the declines experienced in 2023, expectations for 2024 are growing. There is an expectation that transactions will be boosted by interest among private equity investors searching for a business in Latin America to diversify their portfolios, and the possibility that interest rate reduction will improve the conditions required to finance these types of projects. Set against that, however, is uncertainty over political governance in the region.

In addition to global economic challenges, a new opportunity/threat has emerged: that new technologies will oblige M&A advisors to raise their levels of creativity and professionalism. M&A transactions are by nature complex and multi-dimensional. Firstly, the legal design of M&A agreements brings various complexities, including the drafting of intricate clauses, navigating regulatory frameworks, and ensuring compliance with both local and international laws. In this context, ensuring clarity and precision in the legal language becomes paramount to avoid ambiguities and potential disputes down the line.

Secondly, the increased use of AI technologies in M&A transactions introduces another set of challenges. While AI can streamline due diligence processes, enhance contract analysis, and identify potential risks, its adoption requires careful consideration of potential data privacy and security concerns. Ensuring the accuracy and reliability of AI algorithms is crucial to prevent erroneous conclusions or misinterpretations of legal documents, which could have significant implications for the success of M&A transactions.

Additionally, the rapid evolution of AI technologies demands ongoing monitoring and adaptation to keep pace with changing legal landscapes and emerging regulatory requirements. This requires investment in the training of personnel and implementation of robust governance frameworks to mitigate the risks associated with AI-driven decision-making in M&A transactions.

Overall, addressing the challenges posed by legal design and AI in M&A transactions requires a holistic approach that combines legal expertise with technological innovation, risk management strategies, and a commitment to upholding ethical standards and regulatory compliance.

M&A transactions in Colombia

M&A transactions in Colombia have evolved in line with the American and British legal cultures of common law and the structure, clauses, and agreements were all originally adapted from these jurisdictions. Initially, conflict resolution clauses aimed to address disputes in ICC, Texas, and New York courts, as well as in Paris Courts, among others, based on their specialization. Currently, the agreements feature conflict resolution clauses that specify the Colombian arbitration processes as the preferred jurisdiction for resolving disputes, as judges have incorporated American and European legal precedents to adjudicate local disputes.

Labour, tax, environmental, and anti-money laundering/financing of terror (ML/FT) are the four workstreams of a typical transaction, but considering its legal, economic, and operational impact, AML/FT is the area which requires most focus. This is not least due to the significant fines imposed by the Superintendence of Companies during 2023 as a result of non-compliance with companies’ AML policies.

In labour matters, it is crucial for employers to conduct an in-depth review of the nature of employment relationships and the implementation of labour rights, including inclusivity initiatives. On the taxation front, the tax authorities use technology to track every transaction, and any errors in tax returns are penalized. Environmental obligations have not been met by some company administrators, also resulting in hefty fines. Environmental violations have a statute of limitations of 20 years, and some are considered criminal acts by administrators, boards of directors, and shareholders.

AML/FT has emerged as the fastest-growing area within companies due to significant penalties for non-compliance. Argentina, Colombia, and Peru have all implemented robust AML/FT programs (SAGRILAFT, SIPLAFT, SARLAFT, and PTEE). Colombia’s OECD membership mandates AML programs, making assessment of this area a primary focus in M&A due diligence.

Lastly, Human Rights and Environmental, Social, and Governance (ESG) programs are implemented as best practice for companies not listed in the stock market and we expect the same will also become mandatory for private companies within the next two years.

In the gambling sector, it has become clear to some advisors that the primary concerns and adverse effects are not centered around taxation, environmental, and labour issues. Engaging a law firm with a sectoral specialization ensures thorough evaluations focusing on compliance, adherence to technical standards, and a deep understanding of the specific regulations governing gambling.

iGaming M&A transactions: highlights and hurdles

The forecast for 2024 and 2025, is an increase in activity in the gaming sector within Peru, Argentina, and Colombia. This is driven by the expected impact of newly regulated markets with the first two and by the reorganization expected in Colombia.

Colombia led Latin America by regulating online games of chance in 2015, developing a mature legal framework through rigorous regulatory oversight. As a result, the country now boasts the most stringent compliance regulations in the Latin American gaming market.

In the Colombian online gambling sector, aside from the previously mentioned contingencies, there is an additional critical aspect related to compliance, distinct from AML/FT concerns. This involves the contractual obligations under the terms of the operator’s license. The contractual obligations included in the concession contract (licence) set out 94 obligations that operators must fulfil to avoid any breach of the terms of the license. This compliance includes regular reporting to Coljuegos (the regulatory body) at daily, monthly, biannual, and annual intervals, alongside meeting technical compliance requirements (such as software and platform certification) and maintaining in good standing the payment for exploitation rights. Given these factors, compliance evaluation becomes a critical focus in the assessment of an online game of chance operator.

Having said that M&A follows US and European norms, valuation practices and the setting of the transaction price diverge from standard practices, as the buyer is primarily seeking a route to market and market share. This objective de-emphasizes the acquisition of know-how, brand, business model, or profitability, resulting in a valuation based on the seller’s licensing costs, and compliance status, among other key factors.

The regulatory framework of an open market jurisdiction for license applications implies an effort and a specific technique for the correct valuation of the company, which leaves the door open to applying for a new licence.

Representations and warranties in iGaming sector M&A transactions differ significantly due to varying contingency priorities. It is common for an online gambling company in Colombia to have minimal staff employed under local regulations, as operational infrastructure is typically located overseas. Online gambling operators are exempt from VAT and municipal taxes, with only income tax returns being relevant. Environmental considerations are virtually non-existent in this context, shifting again the focus to ensure contractual and technical obligation, as non-compliance in these areas could result in fines or even the declaration of breach of contract with terminations as the worst consequence.

Whilst the opportunities remain attractive, navigating M&A transactions in Colombia’s online gambling sector requires legal guidance from experts with proven industry knowledge. This ensures not only the avoidance of poor investments but also the effective allocation of resources towards comprehensive due diligence and the meticulous drafting of share purchase agreements.